How to electronically file original 1099? | IRS FIRE

![]() Original data is something you have never transmitted to the IRS before.

Original data is something you have never transmitted to the IRS before.

A late original is not a correction. If you never transmitted certain data to the IRS, then put together a

file with just the records that have never been transmitted and upload as originals. If the file is past the

due date, it's considered a late original and may be subject to a penalty. Even if its late, transmit the

data to the IRS.

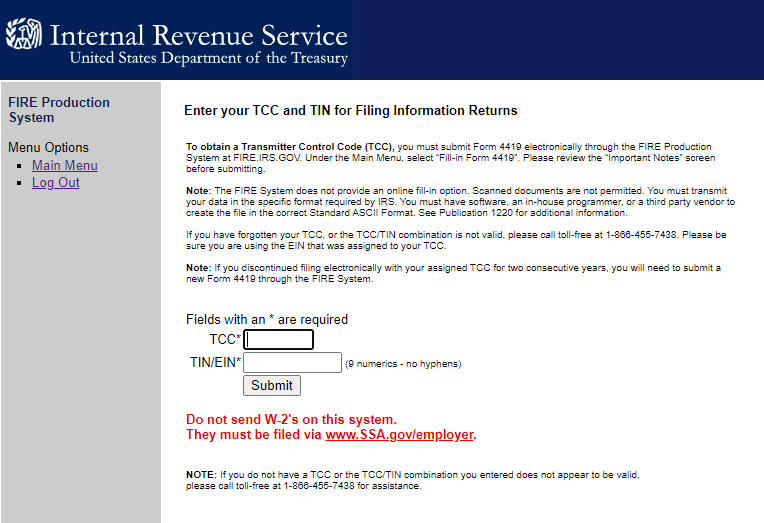

- Log into the site fire.irs.gov

- Click Continue to the Main Menu.

- Click Send Information Returns

- Type in the TCC and TIN.

- Verify your transmitter information. Make sure your e-mail address is current.

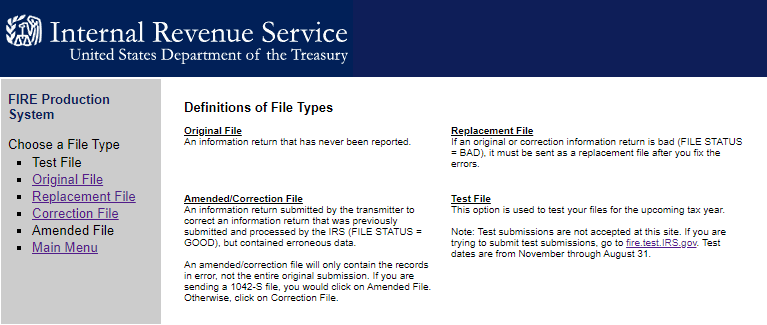

- Select Original as the transmission type.

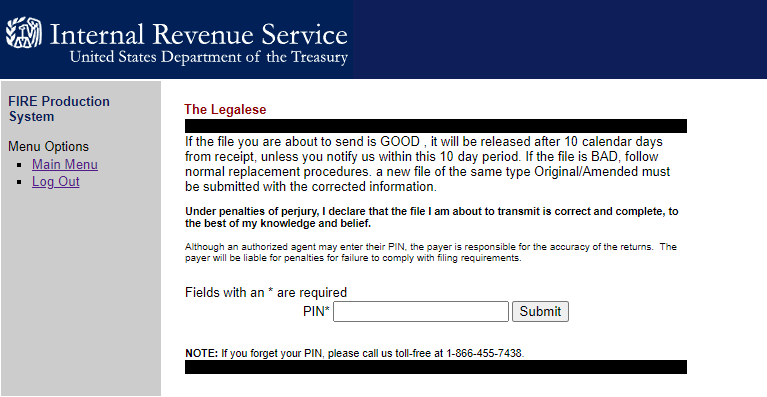

- Type in the PIN.

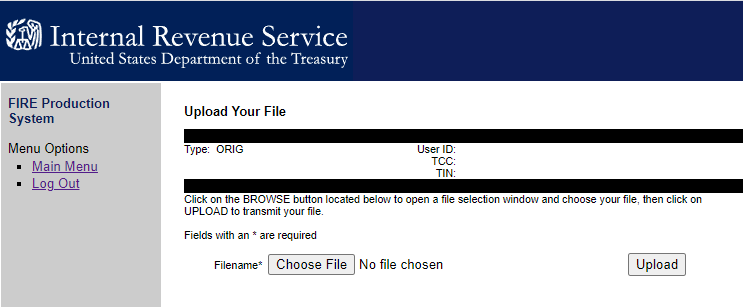

- Click Choose File and find the fire.txt file and click Upload