How to check your file status | IRS FIRE

![]() The IRS FIRE system will e-mail you the file status within 1-5 business days. You can wait for the email to

arrive or you can log into the IRS FIRE site and check the file status at any time.

The IRS FIRE system will e-mail you the file status within 1-5 business days. You can wait for the email to

arrive or you can log into the IRS FIRE site and check the file status at any time.

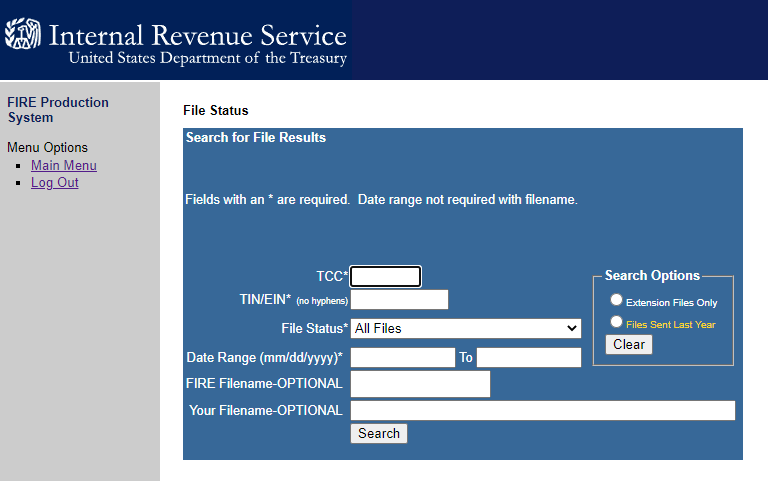

At the Main Menu, click on Check File Status and you will see this screen:

Type in your TCC and EIN number combination, select the File Status, and click Search.

If the file your uploaded was an Original, Correction or Replacement, then you will receive one of

the below results:

Good, Not Released and you agree with the "Count of Payees", you are

finished with this file. The file will automaticaly be released after 10 calendar days. You

have 10 calendar days to call the IRS and ask them to delete the file and they will.

Good, Released - File has been released for processing.

Bad - Correct the errors and timely resubmit the file as a "replacement". Click on the filename

for additional details.

Not yet processed - File has been received, but no results are

available yet. Check back in another day or so.

If the file is a Test, the results will be:

Good, Federal Reporting - Your test file is good for federal reporting

only. Click on the filename for additional details.

Good, Federal/State Reporting - Your file is good for the Combined

Federal/State Filing Program. Click on the filename for additional details.

Bad - This means that your test file contained errors. Click on the

filename for a list of errors. If you send another test

file, send it as another test (not a replacement, original or correction).

Not yet processed - File has been received, but no results are

available yet. Check back in another day.

When you are finished, click on Main Menu and then Log Out.