How to apply for a TCC number? Steps for New IRS FIRE TCC Applicants.

![]() A Transmitter Control Code (TCC) is required to access the IRS FIRE System. New FIRE users must have an ID.me account

which authenticates their identities. It takes 1-3 days to attain a new TCC number online but it takes about a

month to establish an IRS E-Services Account and verify your identity.

A Transmitter Control Code (TCC) is required to access the IRS FIRE System. New FIRE users must have an ID.me account

which authenticates their identities. It takes 1-3 days to attain a new TCC number online but it takes about a

month to establish an IRS E-Services Account and verify your identity.

The IRS encourages transmitters who file for multiple payers to submit one application and use the assigned

Transmitter Control Code (TCC) for all payers.

Here are the steps to attaining a TCC number:

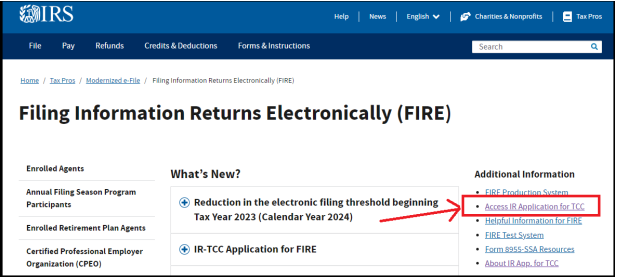

- Go to IR Application for TCC.

- In the upper right corner, click on Access IR Application for TCC.

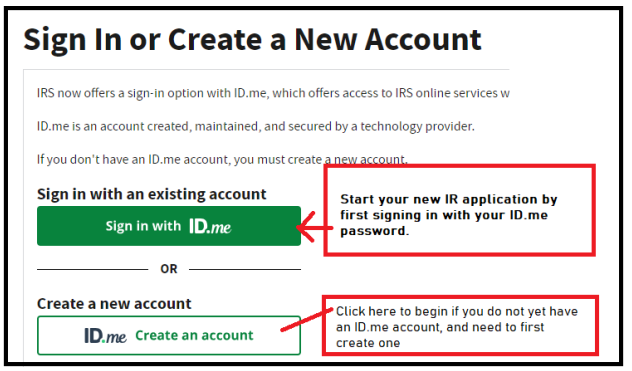

- Log-in with your ID.me user email and Password.

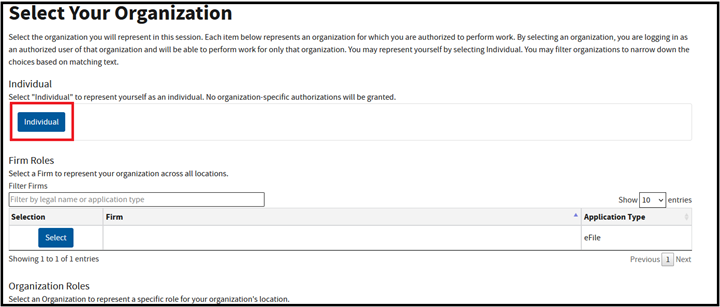

- Select Individual as your organization.

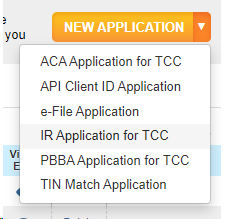

- Click New Application and then IR Application for TCC FIRE from the drop down list.

-

Fill out the form and click Continue. use the exact legal name associated with your EIN. You can use ampersand (&), period(s), dash(-), and comma(s).

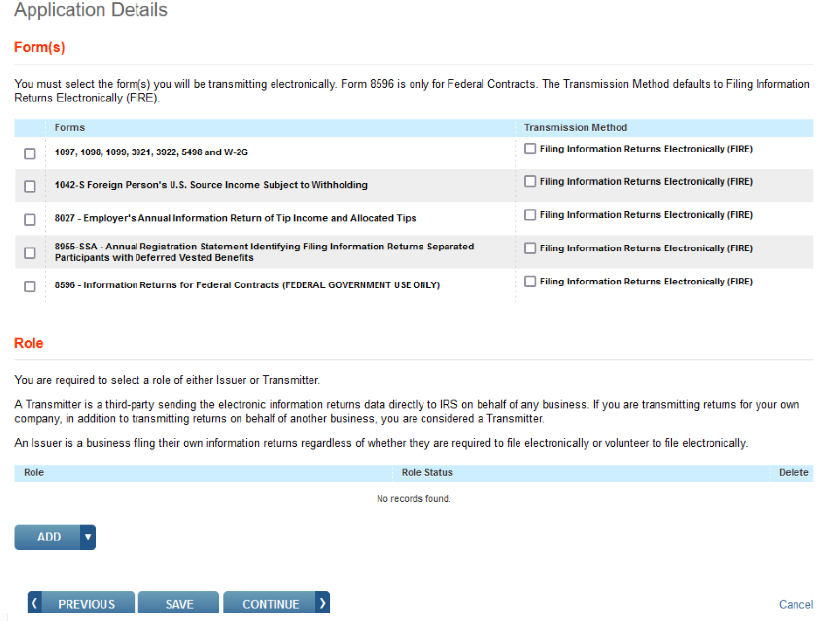

- Sekect the types of form(s) you will be submitting. Then click Continue.

Add Responsible Officials and Contacts. A minimum of two are required. Each responsible official will sign the application with their own 5 digit PIN. Both parties will need an ID.me account. Review the Application Summary and click Continue if it is correct. Check